|

|

#1 |

|

Участник

|

Leon's CRM Musings: Salesforce End of Year Financial Results and Subscription Numbers Versus Dynamics CRM

Источник: http://leontribe.blogspot.com/2013/0...financial.html

============== With the recent release of the Salesforce end of year financials and the release of Dynamics CRM subscription numbers at Convergence, we can kill two birds with one stone and see how Salesforce is going. Unless stated otherwise, all numbers presented are taken from the Salesforce detailed financials (from their web site) and from the announcements made by Microsoft at Convergence. For what it is worth I would love to put the Microsoft financials up against the Salesforce ones but I am yet to see the financials for Dynamics CRM (statistics by region would also be delicious). To this end I can only highlight my delights and concerns in the Salesforce financials, use them to extrapolate subscription numbers and compare these to the ones Microsoft puts out each year (Salesforce has not put out any subscription numbers for over two years). Earnings Call Buzzword Bingo A regular spot in the Salesforce announcements, let us see what Marc and his CFO were thinking about as the end of the year approached. Key phrases of two words or more were:

This Quarter’s Keywords (total words: 3800) Last Quarter’s Keywords (total words: 3000) Last Year’s Keywords (total words: 3400) revenue (45 times) revenue (38 times) revenue (37 times) customers (23 times) cloud (20 times) cash (24 times) cloud (22 times) growth (17 times) cloud (22 times) customer (17 times) customers (13 times) social (19 times) growth (17 times) social (13 times) growth (17 times) service (16 times) marketing (10 times) enterprise (14 times) enterprise (15 times) service (9 times) customers (11 times) cash (13 times) cash (9 times) sales (10 times) marketing (9 times) sales (9 times) service (8 times) social (9 times) customer (8 times) heroku (5 times) sales (8 times) enterprise (7 times) chatter (5 times) margins (7 times) mobile (7 times) customer (5 times) My takeaways:

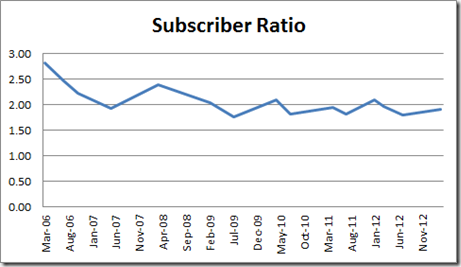

A common wisdom is that while the revenues can be manipulated (*cough* Non-GAAP *cough*), it is much harder to mess with the cash flows. So let us see where Salesforce is getting its cash from. Firstly, in a cashflow statement, cash comes from three places:

Generally speaking, a business should be making its money from operating activities and not so much from selling assets (investing activities) or from taking out loans (financing activities). In Salesforce’s case we have:

Fortunately, another line item in the operating cashflow comes to the rescue; the stock-based awards. This is the cash generated by staff exercising stock options (as I explained in the second quarter analysis). Let us say Salesforce offer a discount scheme for their shares such that, each quarter, an employee can buy Salesforce shares with no brokerage and at a discount to the market price. Many would take up the offer and likely forego salary and bonuses in exchange for such a scheme. Everybody wins. The member of staff recoups their lower wage by getting an asset at a bargain price and Salesforce get to reduce salary expenses and gain some money when the staff exercise their options. So where is the catch? The catch is in where the share came from because, essentially, Salesforce created it from thin air. The gap in the equation is with all these additional shares being created, each individual share is worth a little less and the asset was bought at a fair price, not a cheap price. Fortunately for Salesforce, the market has not caught on to this and the stock price remains high (despite there being 4% more shares in the pool than last year). In an ideal world, the value of the share being printed would be considered an expense, but it is not (because it is assumed the market value of the share will adjust to compensate). To this end, Salesforce get to print money and put it in the operating cashflow to an amount which accounts for over half of our operating cashflow. As long as the share price remains high, everything is fine. Remember how I said “a business should be making its money from operating activities”? This assumes the main source of operating income is from sales, not the printing of shares. In my head I envision Salesforce’s operating income as a game of Jenga. We remove the value of the company from underneath and pile hollow bricks of cash on top. Eventually the market will wake up and the tower will fall down. Investing income is, as I understand it, money spent on acquisitions and mergers. The financing income is a curious one. The best I can make out this the cash from people paying into their pension scheme (which will eventually have to come out). Therefore, overall we have a picture of a company printing shares to generate money to buy other companies and cover the costs of selling at a loss. If this the case, would it not make more sense to invest in the companies being bought, rather than in the company buying them? Revenue and Costs  Revenues (red) grew at around 30% year on year, following the trend of slow deceleration we have been seeing for the past year or so. Unfortunately the cost growth for the same period was 34%. Meaning costs are still running away from revenue and, while this is the case, we cannot expect there to be a profit.  As we can see income is no longer dropping off the cliff, but it is still in the negatives.  In terms of margin, the frightening 9% loss, has now been brought back to around a 3% loss. We are only selling our $10 notes for $9.70 now. Insider Sales Using Yahoo’s insider transaction report for Salesforce we see that insiders (officers and directors) sold off a total of 8% of the shares they own over the past six months. For a company which is described as being such a success, it surprises me that the people who know the story from the inside continue to offload their ownership of the company. Staff Numbers In the third quarter results, I noticed staff growth was tailing off. This deceleration has continued as well. Salesforce is growing its staff, year on year, by about 26%. we have not seen staff growth this slow since 2010. Subscription Numbers I recently tweeted an infographic suggesting Salesforce had less users than Dynamics CRM. After digging into the statement, it seems Capterra’s source of numbers was this. At best, this is true only of the Sales Cloud subscriptions. Historically, I have compared subscriptions of the entire Salesforce stack to Dynamics CRM so I will continue with my tradition. While Salesforce do not release subscription numbers, we can guess at the numbers from the revenue being generated. Using the same methods of estimating as previously adopted, I predict Salesforce has around 5.8 million users and 165,000 customers. Assuming this is correct, the two are maintaining a subscriber ratio of just under 2:1 to each other.  Conclusions For Salesforce, it is still mainly about revenue, customers and the cloud. The cashflow into the business appears to be driven from the purchasing of shares through options, rather than through sales. Profits are still elusive. My hope is the cost growth can be managed so that the business can be brought slowly back to profitability. Finally, in terms of how the two products fare, Salesforce has a user base approximately double that of Dynamics CRM, although Dynamics CRM has larger customers. This seems to be an on-going trend with the two products. Источник: http://leontribe.blogspot.com/2013/0...financial.html

__________________

Расскажите о новых и интересных блогах по Microsoft Dynamics, напишите личное сообщение администратору. |

|

|

|

|

|